Ask CENTRL: What Should Investment Companies Do to Comply with Australia’s Modern Slavery Act?

Many investors and investment companies have adopted Environmental, Social, and Corporate Governance (ESG) programs to measure and ensure the sustainability and minimize the adverse societal impact of their investments in particular companies and businesses. The social component of these programs includes, among other things, a broad focus on human rights issues. Australia’s Modern Slavery Act of 2018 (MSA) adds a heightened focus on one important human rights issue : forced labor, human trafficking, and other forms of modern slavery.

All companies that meet the eligibility criteria for modern slavery reporting are required to comply with requirements of the MSA. Although every industry sector has unique characteristics that will impact how they approach this compliance exercise, one of the things that sets investors and investment companies apart is that their core investment activities are part of both their internal business operations and external supply chains. Investment companies are businesses with their own unique business operations and supply chains, but they are also investors in other companies. This unique business model adds a twist on how investors and investment companies should approach MSA compliance, but it also means they have the ability to exercise significant leverage to influence change in the marketplace and this leverage will impact how they navigate these new requirements.

Business Operations versus Supply Chains

The Guidance for Reporting Entities (GRE) published by the Australian Border Force (ABF) provides the following guidance on how investment companies should view their operations and supply chains:

… the operations of superannuation funds and fund managers include internally managed investment portfolios and assets. Externally managed portfolios, such as those managed by another fund manager, may be more appropriately considered part of the reporting entity’s supply chains …. Entities’ operations also include making financial investments in, and engagement with, non-managed/non-operated joint ventures (although the joint venture is not a managed operation, the entity’s investment in and engagement with the joint venture is a business activity).

In light of their unique business model, investment companies should consider structuring their MSA compliance program to assess modern slavery risks in their:

- Business operations, which includes internally managed portfolios and assets; and

- Supply chains, which include two channels:

- “Traditional” supply chains, such as information technology procurement services, printing services, external accountants and auditors, and facilities and waste management services, and

- “Nontraditional” supply chains, such as externally managed investment portfolios and non-managed/non-operated joint ventures.

Managing Modern Slavery Risks in Financial Investments

Like companies in other industries, investment companies have “traditional” suppliers across different business functions. Investment companies will need to assess the risk of modern slavery in this supply chain using a risk-based approach that focuses on key factors, such as business sector, geography, and employment practices. Investment companies can send assessment questionnaires to these suppliers and then evaluate their responses to determine whether remedial action is needed to address any identified modern slavery risks. Investment companies may opt to send the same assessment questionnaire to all of their suppliers, or they may elect to pre-rate suppliers based on certain objective risk factors and send different questionnaires that reflect these risk factors. This assessment approach is no different than the approach companies in other industries will need to employ to meet the annual reporting requirements of the MSA.

Investment companies will also have to focus on assessing and addressing modern slavery risks in their investments, whether the investments are part of their business operations or supply chains. The GRE notes, as follows:

Reporting entities that engage in investment activities often do not have control over the actions of the investee. In these situations, entities are not required to monitor or report on the operations and supply chains of their individual investees. For example, an investment firm is not required to individually monitor or report on each of its investees and their operations and supply chains. … Although not required to monitor or report on individual investees or loan recipients, the Government expects that reporting entities assess at an overarching, thematic level whether they may be exposed to modern slavery risks through their investment arrangements and/or financial lending practices. This includes investment activities in relation to non-managed/operated joint ventures. Reporting entities should also consider how they may be able to address any significant areas of risk through their investment and/or financial lending arrangements. The way reporting entities address risks in this context will depend on the nature of their investments and investment arrangements. For example, in some cases investors will have significant influence over portfolios even where these portfolios are managed externally.

Assessing modern slavery risks in investment portfolios can be a complicated exercise. Investment companies may maintain investments in hundreds of firms, either in their internally or externally managed portfolios. However, investment companies may use assessment questionnaires to identify and assess and help to address modern slavery risks in their investment portfolios. For example, an investment company may send an assessment questionnaire asking a fund manager of an externally managed portfolio to report on modern slavery risks both as a supplier and as to the assets being managed by that fund manager.

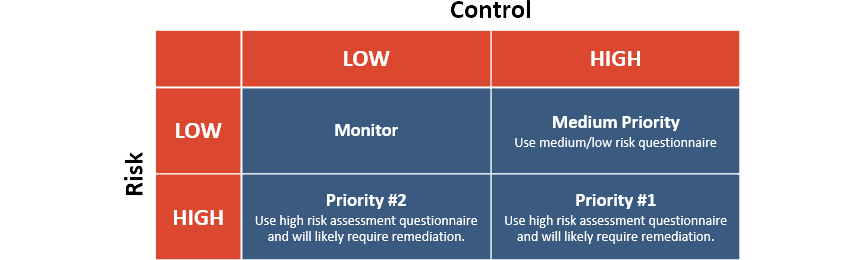

To assess and address modern slavery risks in their “nontraditional” supply chains, investment companies may elect to use an approach that focuses on two factors: (1) modern slavery risks, and (2) their ability to exercise control in the investment relationship. More specifically, investment companies can assess the modern slavery risks in their investments and investment arrangements by reviewing their portfolio using the simple matrix below that focuses on the “risk to people”, a term that incorporates, among other things, the severity of the modern slavery practices, the likelihood of occurrence, and the number of people affected over a particular time period, and the company’s level of control or leverage to influence change in the investment:

This two-pronged approach can provide a simple framework for prioritizing an investment company’s MSA compliance exercise. By organizing their investments in this simple matrix, investment companies can use the same modern slavery risk criteria used in evaluating risks in their supply chains, such as the level of country risk. The level of control that an investment company may have in each investment can be determined using both financial and operational metrics. For example, if an investment company maintains a majority ownership in the investee, the investment company would be considered as having a high level of control in the investment. This may also be the case if the investment company maintains a position on the board or other governing body of the investee.

As noted above, investment companies may opt to send the same assessment questionnaire to its “non-traditional” suppliers, or they may elect to pre-rate these suppliers based on certain objective risk factors and send different questionnaires that reflect these risk factors. As the chart above highlights, investment companies should focus on any investment that falls in the high risk/high control quadrant. Modern slavery issues should also be addressed in any investment that falls in the high risk/low control quadrant. These risks may be more difficult to address and remediate because the investment company will not have a high level of control, but all companies must focus on addressing areas in which there are the greatest risks of modern slavery to people.

Next Steps

The MSA requires companies to submit annual modern slavery reports to the ABF. The first reporting deadline for companies with an Australian Financial Year is March 31, 2021. Although the MSA prescribes the general content requirements for these reports, the MSA does not prescribe any particular actions that a reporting entity must take to address modern slavery risks. However, most companies, including investment companies, will want to use assessment questionnaires to identify and assess the modern slavery risks in their internal business operations and external supply chains and to help them determine appropriate remediation measures. Investment companies face unique compliance issues because of the nature of their business. However, they still can use some of the same tools to address and assess modern slavery risks in their operations and supply chains as other reporting entities.

Warren Buffett once said that “risk comes from not knowing what you’re doing.” The MSA’s annual reporting requirements are new so all reporting entities, regardless of industry, are navigating these new compliance requirements. Investment companies are not new to risk evaluation, but the focus of this evaluation changes under the MSA from the risk to your business to the risk to people. Investment companies should build their MSA compliance programs to not only reflect the mandatory reporting requirements, but also to reflect the unique nature of people risks in their business operations and supply chains.

Since this is a new exercise for all reporting entities, the first steps in building out your program may not be easy. Using assessment questionnaires and focusing on the risk and control framework outlined above should make it easier for investment companies to move forward from good cause to a great modern slavery compliance program.